KEY FINANCIAL EVENTS

|

Date |

Event |

|---|---|

|

2020 |

The news from China about the outbreak of the new virus appeared for the first time in December 2019. On March 11, 2020, the World Health Organization announced the new type of virus COVID-19 outbreak a pandemic. According to the decree of the President of the Republic of Kazakhstan dated March 15, 2020 No. 285 “On the establishment of a state of emergency in the Republic of Kazakhstan”, a state of emergency was established across the country from March 16, 2020 through May 11, 2020. Most cities in Kazakhstan were quarantined, and operations of most industrial enterprises were suspended from March 30 to May 11, 2020. In response to the pandemic, the Kazakh authorities are taking numerous measures aimed at preventing the spread and exposure of COVID-19, such as travel bans, quarantines, restrictions on business, etc. These measures, among other things, seriously curtail business activity in Kazakhstan, have a negative impact upon and continue to adversely affect business, market participants, customers of the Company, as well as on the Kazakhstani and global economy for an unknown period of time. Along with that, on March 9, 2020, oil prices plummeted because of discrepancies between OPEC members and other major oil-producing countries, the price of Brent crude in March 2020 fell below $25 per barrel. Since the beginning of 2020, tenge has depreciated against the US dollar by circa 10 %. As of December 31, 2020, the price of Brent crude oil was USD 51.80 per barrel, with a further forecast increase in the price. Today, the situation is still developing. At this, no significant effect on proceeds and supplies of the Company was observed. Electricity output across the Group amounted to 31.4 bn kWh in 2020, which is 3 % higher than the plan and the actual figure for the previous period by 4 %. The main factor contributing to an increase in output compared to the last year is 2.3 % growth of electricity consumption in the North and South of the Republic of Kazakhstan. Moreover, the Group’s share in electricity generation in Kazakhstan in 2020 amounted to 29 %, which is 2 % higher than last year’s figure. Revenue in 2020 amounted to 283 bn tenge, which is 16 % higher than last year. The Group’s EBITDA amounted to 99.7 bn tenge, which is 21 % higher than the previous year’s actual. The main driver for revenue and EBITDA growth compared to the previous year is an increase in electricity tariffs and production volumes. At the same time, it is hard to forecast the future outcome. The Company will continue to monitor the potential effect of the above-mentioned events and will take all necessary steps to prevent negative consequences for the business, just to name a few: the consequences of downtime / quarantine resulted from COVID-19 pandemic will lead to a slowdown in business activity in general, which may affect the financial performance of the Company in the future; as part of new agreements between OPEC members and other large oil-producing countries, Kazakhstan and Russia have committed to slash production under new agreements between OPEC members and other major oil producing countries; further devaluation of tenge against the US dollar will have a negative impact on the Company’s financial performance. At the same time, the below mentioned event, which positively impacts the Company’s financial stability, has occurred: The methodology for determining the fixed profit included in electricity tariff, with the entry into force from 2021, was approved by the Order of the RK ME No. 205 d/d May 22, 2020, which will allow obtaining profitability from the sale of electricity by EPO in addition to fully covering the cost of goods sold. |

|

January 1, 2020 |

For subsidiaries and affiliates implementing large-scale investment programs, which includes debt financing, in 2019, Investment agreements were concluded with the Ministry of Energy of the Republic of Kazakhstan and individual tariffs for capacity were approved. - For “Almaty Power Plants” JSC and “Moynak HPP” JSC tariffs were put into effect from 01.01.2020, and for “Shardarinsk HPP” JSC tariffs were put into effect from 01.03.2020. |

|

January 30, 2020 |

According to the Rules for admission to consideration of investment programs (MOE Order No. 416 on November 28, 2017), in order to conclude an investment agreement for the project “Restoration of 500 MW Power Unit No. 1”, ESDPP-1 sent a corresponding investment program to the Market Council for consideration. Received a positive recommendation from the Market Council for further consideration of the investment program in the authorized body. |

|

May 21, 2020 |

Amendments have been made to the order of the Minister of Energy of the Republic of Kazakhstan dated March 2, 2015 No. 164 “On approval of the Rules for the centralized purchase and sale by the financial settlement center of electrical energy produced by facilities for the use of renewable energy sources, recalculation and redistribution by the financial settlement center center of the corresponding share of electricity to qualified conditional consumer based on the results of the calendar year “(hereinafter – the Rules). The changes will allow renewable energy facilities to extend once the terms specified in subparagraphs 1) and 2) of paragraph 106 of the Rules for a period not exceeding 1 calendar year, according to the request of the Applicant (in any form), within the framework of excluding non-fulfillment of obligations to FSCs LLP. |

|

May 22, 2020 |

By order of the Minister of Energy of the Republic of Kazakhstan dated May 22, 2020 No. 205, a new “Methodology for determining the fixed profit taken into account when approving the maximum tariffs for electricity, as well as the fixed profit for balancing taken into account when approving the maximum tariffs for balancing electricity” was approved. The methodology provides for a “transition period”, during which the fixed profit is calculated based on the cost of generating electricity in 2019 and is set at 11.79 %. A full transition to RAB-regulation will take place from 01.01.2021. |

|

June 17, 2020 |

Changes were made to the order of the Minister of Energy of the Republic of Kazakhstan dated November 28, 2017 |

|

June 18, 2020 |

The credit limit was increased to 38 bn. tenge by concluding an additional agreement to the agreement on the provision of a credit line between LLP “ESDPP-1” and JSC “Halyk Bank of Kazakhstan” |

|

June 22, 2020 |

JSC “Shardara HPP” received a letter of consent (waiver) from the European Bank for Reconstruction and Development to cancel the current liquidity ratio indefinitely. |

|

June 26, 2020 |

The international rating agency Fitch Ratings has affirmed the Company’s long-term credit ratings in foreign and national currencies at BB, Outlook Stable; short-term foreign currency credit rating at “B”; national long-term rating at “A + (kaz)”, forecast “Stable”. The agency also raised the credit rating of the Company on an independent basis from “B” to “B +”, the priority unsecured ratings of the Company in foreign and national currency from “BB-” to “BB” and the national priority unsecured rating from “A- (kaz) “to” A + (kaz) “. |

|

June 29, 2020 |

The Ministry of Energy of the Republic of Kazakhstan has published the maximum tariffs for electricity for stations with commissioning from 07.01.2020. For subsidiaries and dependent companies of JSC “ESDPP-2” and JSC “Almaty Power Stations” the tariffs were approved with an increase of 18 %., For LLP “ESDPP-1” the tariff growth was 0.7 %. For JSC “Moynak HPP” the tariff is kept at the current level. And for “Shardara HPP” JSC the tariff was reduced by 7.1 %. Taking into account the growth of the maximum tariffs at the stations, subsidiaries and dependent companies – LLP “AlmatyEnergoSbyt” 07.24.2020 submitted to DKREM a notification application for approval of an increase in the electricity tariff from September 1, 2020. The projected tariff is 19.38 tenge / kWh (with an increase to the current one by 13.2 %). |

|

August 19, 2020 |

JSC “ESDPP-2”, whose parity shareholders are JSC “Samruk-Kazyna” and JSC “Samruk-Energy”, refinanced all liabilities in foreign currencies for a total amount of about 100 billion tenge. Thus, the station fully neutralized currency risks, freed up collateral, and optimized associated costs. |

|

August 27, 2020 |

The credit line of “ESDPP-1” LLP in SB Sberbank of Russia JSC was extended until September 29, 2021. |

|

November 06, 2020 |

Tariffs approved for AZhK by order of DKREM in Almaty from 06.11. No. 126-OD for the period from 2021 to 2025. 2021 – 6.04 tenge/kWh; 2022 – 6.42 tenge/kWh; 2023 – 6.69 tenge/kWh; 2024 – 7.10 tenge/kWh; 2025 – 7.36 tenge/kWh |

|

November 18, 2020 |

On the trading floor of KOREM JSC, centralized auctions for electric capacity for 2021 were held. Following the auction results, Samruk-Energy JSC sold 2,768 MW, incl. Almaty Power Stations – 490 MW, ESDPP-2 – 625 MW, ESDPP-1 – 1,653.91 MW. |

|

12 months of 2020 |

The funds borrowed from EDB in the amount of 43 mln tenge were disbursed to finance the project Cyclical-and-continuous method of “Bogatyr Komir” LLP and in the amount of 6,9 bn.tenge in order to finance the project Construction of 50 MW WPP in Ereymentau city. |

|

December 03, 2020 |

According to the Rules for Admission to the Consideration of Investment Programs (Order of the Ministry of Energy of November 28, 2017 No. 416), the Ministry of Energy included in the list of power plants with which investment agreements will be concluded, ESDPP-1 with the project “Restoration of power unit No. 1 with a capacity of 500 MW”. |

|

December 07, 2020 |

The President signed the Law of the Republic of Kazakhstan “On Amendments and Additions to Certain Legislative Acts of the Republic of Kazakhstan on Supporting the Use of Renewable Energy Sources and Electricity”, which was developed to stimulate the construction of flexible capacities, establish an end-to-end tariff for supporting renewable energy sources, as well as to improve the current legislation of the Republic of Kazakhstan in the field of renewable energy. |

|

December 14, 2020 |

The Board of Directors has confirmed the financial stability of the Company by placing it in the “green” zone of credit risk. |

MACROECONOMIC FACTORS

The past 2020 was burdened with unfavorable economic environment across the globe in connection with implications of COVID-19 virus spread, including in the Republic of Kazakhstan. According to an analytical report prepared by Halyk Finance, there has been a progressive improvement in the economic situation in the 4th quarter of 2020 owing to the growth of global oil prices, easing of quarantine measures, double-digit growth in nominal wages and businesses adapting to restrictions.

By the end of 2020, Kazakhstan’s economy showed improvement in key indicators with a minimum decline in GDP for the year at the level of 2.1 % y/y. In general, GDP reduced by 2.6 % y/y in 2020, while the economy was gripped by recession for the first time in the last two decades.

According to data from the Statistics Committee under the RK MNE, in the 4th quarter of 2020, inflation peaked up to 2.6 % over the year, along with this the annual inflation substantially exceeded the indicators of recent years. Inflationary pressures were triggered by the weakening of the national currency, increased government spending (24 % of GDP vs. 20 % of GDP in 2019), an increase in regulated tariffs (+3.5 % versus –2.7 % in 2019) and fever in the food market.

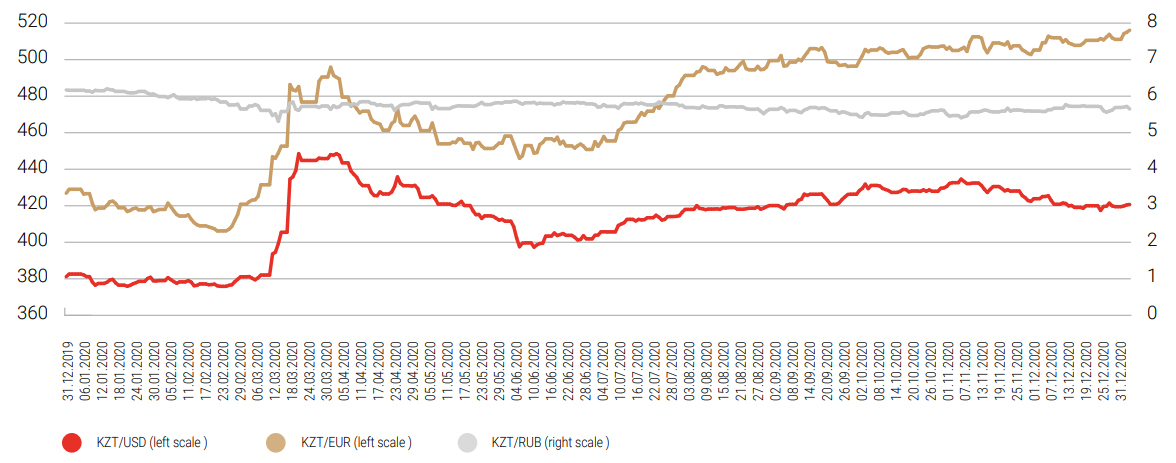

During the year, the regulatory authorities pursued an active policy in the foreign exchange market due to deteriorating foreign economic environment, which helped to keep currency rate from falling even further. The national currency weakened by 10.4 % to 420.71 tenge/USD over the year, strengthened by 2.0 % the 4th quarter of 2020. The growth of oil quotations by 26.5 % to $51.8 per barrel has been the main driver for stabilization of the national currency rate in the 4th quarter.

In December, the regulator maintained the base rate at 9 %, while reducing the liquidity management corridor from +/- 1.5 % to +/- 1 %. The main parameters of the base rate reached the pre-crisis level, at which inflation was at the level of 5.3–5.4 %. At that time, the regulator determined monetary conditions as neutral. Now, when inflation is set at the level of 7.4–7.5 %, and the rate corresponds to the pre-crisis level, such monetary conditions can be described as incentive (source Halyk Finance).

Dynamics of currency exchange rates:

|

|

31.12.2019 |

31.12.2020 |

% |

|---|---|---|---|

|

KZT/USD |

381.18 |

420.71 |

110 |

|

KZT/EUR |

426.85 |

516.13 |

121 |

|

KZT/RUB |

6.17 |

5.65 |

92 |

PRINCIPLES OF ACCOUNTING POLICY

The Company’s operations in 2020 in electric power and coal sectors were carried out in accordance with the approved plans.

For the purposes of a single approach to preparing a report on business and financial performance, “Samruk-Energy” JSC group of companies uses the equity method in consolidation. In addition, in accordance with existing accounting policies, fixed assets and intangible assets are reported at initial cost, that is, without taking into account revaluation. Subsidiaries are included in the consolidated financial statements using the acquisition method. Acquired identifiable assets, as well as liabilities and contingent liabilities received at a business combination are stated at fair value at the date of acquisition, irrespective of the amount of the non-controlling interest.

Based on the foregoing, when using the equity method in the consolidated balance sheet, turnovers of such large companies as “Ekibastuzs SDPP-2 Plant” JSC, coal assets company Forum Muider B.V., 50 % of interest of which belong to “Samruk-Energy” JSC were excluded.

When forming the consolidated financial result of “SamrukEnergy” JSC, the share of profit on these companies is presented in the item “share of profit / loss of organizations accounted for using the equity method and impairment of investments”.