The laws of the Republic of Kazakhstan “On Electricity”, “On Natural Monopolies and Regulated Markets” and “On Competition” govern the operations of the Group’s subsidiaries and joint ventures, which are natural monopoly and regulated markets entities and entities with a dominant position in a competitive market. Tariff regulation, depending on the type of energy companies, falls within the competence of the Committee on Regulation of Natural Monopolies and Protection of Competition of the Ministry of National Economy of Kazakhstan (hereinafter – the Committee) or industry-specific ministry – the Ministry of Energy (hereinafter – ME).

Tariffs for electricity for energy-producing organizations (hereinafter – EPO) for the period from 2016–2018, were set at the level previously approved for 2015, marginal tariffs for stations.

Based on the Concept for the Development of the Fuel and energy sector (FES) of Kazakhstan until 2030, adopted in 2014, the Capacity Market was introduced in 2019 as an effective mechanism for providing the industry with a sufficient level of investment, which will have a favorable effect on the market in the long term.

During 2019 taking into account the introduction of a capacity market for energy-producing organizations, the following have been formed:

- marginal tariffs for capacity, including the costs of investment projects and repayment of the main debt (for credit funds raised for the implementation of investment projects);

- marginal tariffs for electricity, including the costs of operating expenses and fixed profit. By order of the Minister of Energy of the Republic of Kazakhstan dated May 22, 2020 No. 205 “Methodology for determining the fixed profit, taken into account when approving the maximum tariffs for electricity, as well as the fixed profit for balancing, taken into account when approving the maximum tariffs for balancing electricity” was approved

Tariffs for the supply of electric energy produced by renewable energy sources are fixed and approved by the Government of the Republic of Kazakhstan depending on renewable energy technology (separately for wind, solar and other sources) and are subject to annual indexation. At the same time, Financial Settlement center acts as a buyer, and the energyproducing organization acts as a seller.

Tariffs for the transmission and distribution of electricity for energy transmission companies, for the production of heat energy and tariffs for energy supply (ESO) are regulated by the Committee on Regulation of Natural Monopolies and Protection of Competition of the Ministry of National Economy of the Republic of Kazakhstan. Regulation and control by the Committee is carried out in strict accordance with legislative and regulatory acts.

Social and political issues significantly influence tariff decisions. Economic, social and other policies of the Government of the Republic of Kazakhstan may have a significant impact on the Group’s operations.

TARIFF STATE REGULATION OF SPECIES COMPANY ACTIVITIES

Weighted average tariffs for electricity generation

|

# |

Description |

2018 Actual |

2019 Actual |

2020 Actual |

2021 Forecast |

2022 Forecast |

|---|---|---|---|---|---|---|

|

1 |

“Ekibastuz SDPP-1” LLP average weighted tariffs, tenge/kWh |

6.85 |

6.07 |

6.44 |

7.67 |

9.87 |

|

|

Export tariff, tenge/kWh |

5.18 |

9.64 |

10.22 |

10.75 |

10.75 |

|

|

RK tariff, tenge/kWh |

7.28 |

5.87 |

5.86 |

7.39 |

9.84 |

|

|

including electricity tariff, kWh, tenge/kWh |

|

5.65 |

5.65 |

6.63 |

8.98 |

|

|

including capacity tariff, thous.tenge/MW*month |

|

590 |

590 |

590 |

614 |

|

2 |

“Ekibastuz SDPP-2 Plant” JSC average weighted tariffs, tenge/kWh |

7.53 |

8.70 |

9.64 |

9.91 |

9.95 |

|

|

Electricity tariff, tenge/kWh |

|

7.42 |

8.55 |

9.13 |

9.13 |

|

|

Capacity tariff, thous.tenge/MW*month |

|

590 |

590 |

590 |

614 |

|

3 |

“Almaty Power Plants” JSC average weighted tariffs, tenge/kWh |

8.60 |

9.66 |

11.41 |

12.54 |

13.40 |

|

|

Electricity tariff, tenge/kWh |

|

8.43 |

9.45 |

10.66 |

11.65 |

|

|

Average weighted capacity tariff, thous.tenge/MW*month |

|

|

875 |

883 |

820 |

|

|

Capacity tariff, thous.tenge/MW*month |

|

590 |

590 |

590 |

614 |

|

|

Individual capacity tariff, thous.tenge/MW*month |

|

|

4,169 |

4,169 |

3,139 |

|

4 |

“Shardara HPP” JSC average weighted tariffs, tenge/kWh |

9.50 |

4.86 |

12.95 |

13.81 |

15.87 |

|

|

Electricity tariff, tenge/kWh. |

|

4.23 |

8.49 |

9.15 |

11.21 |

|

|

Capacity tariff, thous.tenge/MW*month |

|

590 |

4,069 |

3,868 |

3,868 |

|

5 |

“Moynak HPP” JSC average weighted tariffs, tenge/kWh |

9.51 |

10.02 |

21.33 |

21.88 |

21.94 |

|

|

Electricity tariff, tenge/kWh |

|

7.93 |

12.02 |

12.02 |

12.02 |

|

|

Capacity tariff, thous.tenge/MW*month |

|

590 |

2,564 |

2,564 |

2,564 |

|

6 |

“Samruk-Green Energy” LLP, tenge/kWh |

45.11 |

48.54 |

32.73 |

18.88 |

20.00 |

|

7 |

“First Wind Power Plant” LLP, tenge/kWh |

28.31 |

30.03 |

31.62 |

33.20 |

34.53 |

|

8 |

«Ereymentau Wind Power» LLP, tenge/kWh |

|

|

|

|

22.68 |

|

9 |

“Energiya Semirechiya”, LLP, tenge/kWh |

|

|

|

22.68 |

23.59 |

The following tariffs were in effect during the reporting period:

From January 1, 2019, the electric capacity market began to function in the Republic of Kazakhstan. The income received by electricity producers is divided into two components – income from the sale of electricity (allocated to cover current expenses) and income from the provision of services to maintain readiness of electricity capacity (allocated to repay the main debt and investments). The unified marginal tariff for the service of maintaining the availability of electric capacity for all EPOs in the amount of 590 thous. tenge /MW*month was approved. Electricity tariffs approved for the period 2020–2025. However, the approved tariffs do not provide for profitability and indexation by year. Moreover, according to paragraph 2 of Article 12-1 of the Law of the Republic of Kazakhstan “On the Electric Power Industry”, if necessary, electricity tariffs are adjusted annually.

With the introduction of the capacity market, the weighted average tariffs for electricity in 2020 for stations increased, taking into account the commissioning adjusted tariff caps and the introduction of individual capacity tariffs from July 1, 2020. In connection with the approval of the Ministry of Energy of the Republic of Kazakhstan of deficit tariffs for stations, in accordance with the Regulations, the EPO submitted applications to the Ministry of Energy of the Republic of Kazakhstan for adjusting the ceiling tariffs for electricity. As a result, from July 1, 2020 the Ministry of Energy of the Republic of Kazakhstan approved the following maximum electricity tariffs.

For “Ekibastuz SDPP-1” LLP, the tariff increased slightly – 5.80 tenge/kWh. A significant increase in tariffs for the “Ekibastuz SDPP-2” JCS and “Almaty Power Plants” JCS as made in the amount of 18.4 % and 18.4 %, respectively, due to an increase in costs. For “Moynak HPP” JCS, the tariff has been kept at the current level. The tariff for “Shardara HPP” JCS was reduced by 7.1 % and amounted to 8.10 tenge / kWh. (at the previously approved tariff of 8.72 tenge / kWh).

|

EPO name |

Approved by ME RK |

Dev |

||

|---|---|---|---|---|

|

From October 1, 2019 |

From July 01, 2020 |

(+,-) |

in % |

|

|

“Ekibastuz SDPP-1” LLP |

5.76 |

5.80 |

0.04 |

0.7 |

|

“Ekibastuz SDPP-2” JCS |

7.73 |

9.13 |

1.4 |

18.1 |

|

“Almaty Power Plant” JCS |

8.70 |

10.30 |

1.6 |

18.4 |

|

“Moynak HPP” JCS |

12.02 |

12.02 |

0 |

0 |

|

“Shardara HPP” JCS |

8.72 |

8.10 |

–0.62 |

–7.1 |

For 2020 work has been carried out with the Ministry of Energy of the Republic of Kazakhstan on the approval of investment tariffs for stations implementing large-scale investment projects – “Moynak HPP” JCS, “Shardara HPP” JCS and “Almaty Power Plant” JCS.

|

EPO name |

Volume |

Individual tariff |

Period |

|---|---|---|---|

|

“Almaty Power Plant” JCS |

69.5 MW |

4,168.60 |

2020–2024 |

|

“Moynak HPP” JCS |

298 MW |

2,563.67 |

2020–2026 |

|

“Shardara HPP” JCS |

61 MW |

4,069.3 |

2020–2028 |

On 30.01.2020 an application by “Ekibastuz SDPP-1” LLP was submitted to the Market Council (KEA) for the approval of an individual tariff for the implementation of the project “Restoration of power unit No. 1 with the installation of new electrostatic precipitators.

On 28.02.2021 “Ekibastuz SDPP-1” LLP concluded an investment agreement with the Ministry of Energy of the Republic of Kazakhstan for modernization, reconstruction, expansion and renewal for the Restoration of power unit No. 1 with a tariff setting of 1,199 thous. nd tenge/MW*month for the period 2025–2031 based on the volume of services 476.6 MW.

26.01.2021 an application by Ekibastuz SDPP-2” JCS was submitted to the Market Council (KEA) for the approval of an individual tariff for the implementation of the project “Expansion and reconstruction of EPS-2 with the installation of power unit No. 3”. After receiving the approval of the Market Council, the application will be sent for consideration to the Ministry of Economy of the Republic of Kazakhstan.

From 2021 onward, electricity and capacity tariffs are projected taking into account the consumer price index.

Tariffs for the supply of electrical energy produced by facilities for the use of renewable energy sources are fixed and approved by the Government of the Republic of Kazakhstan, depending on the renewable energy technology (separately for wind, solar and other sources) and are subject to annual indexation.

Tariffs for heat production, tenge/Gcal

|

Company name |

2018 Actual |

2019 Actual |

2020 Actual |

2021 Forecast |

2022 Forecast |

|---|---|---|---|---|---|

|

“Almaty Power Plants” JSC |

3,917 |

3,354 |

3,441 |

3,467 |

3,929 |

|

“Ekibastuz SDPP-2 Plant” JSC |

816 |

809 |

697 |

867 |

902 |

|

“Ekibastuz SDPP-1” LLP |

446 |

572 |

367 |

496 |

496 |

The legislation envisages the approval of long-term (5+ years) ceiling tariff levels for organizations producing heat, with the inclusion of the investment component and annual cost indexation. The Committee for the Regulation of Natural Monopolies and the Protection of Competition approves ceiling tariffs. However, an increase in tariffs is made no more than once a year and there are risks that tariffs remain unincreased in case a power plant’s costs grow for objective reasons.

Tariffs for electricity transmission services, tenge/kWh

|

Company name |

2018 Actual |

2019 Actual |

2020 Actual |

2021 Forecast |

2022 Forecast |

|---|---|---|---|---|---|

|

“Alatau Zharyk Company” JSC |

5.89 |

5.46 |

5.95 |

6.04 |

6.42 |

For “Alatau Zharyk Company”, JSC which is also a subject of a natural monopoly, maximum long-term tariffs have been approved on the basis of tariff estimates with the inclusion of an investment component for 2016–2020 for regional energy transmission companies (RECs), if necessary, are adjusted by the authorized body.

In July 2020, AZHK submitted an application and order of DKREM in Almaty dated 06.11. No. 126-OD approved the maximum long-term tariffs for the period from 2021 to 2025.

|

Period |

2021 |

2022 |

2023 |

2024 |

2025 |

|---|---|---|---|---|---|

|

Approved tariff |

6.04 |

6.42 |

6.69 |

7.10 |

7.36 |

The increase (adjustment) of tariffs is made no more than once a year, in cases of growth in the costs of RES for objective reasons (acceptance of ownerless networks and equipment on the balance sheet, etc.). There are also risks of maintaining tariffs without increasing.

Tariffs for selling electricity by ESO, tenge/kWh

|

Company name |

2018 Actual |

2019 Actual |

2020 Actual |

2021 Forecast |

2022 Forecast |

|---|---|---|---|---|---|

|

“AlmatyEnergoSbyt” LLP |

16.42 |

16.11 |

17.66 |

20.15 |

22.42 |

The energy supply company “AlmatyEnergoSbyt” LLP is a subject of a socially significant market and is also subject to regulation by the authorized body. The tariff calculation includes operating, financial and investment components. There are risks of artificial containment of tariff growth by the Regulator in order to maintain social stability of the population in the regions. For ESO, differentiation is maintained for individuals according to consumption norms, for legal entities, electricity is supplied at average selling rates.

Coal sale price, tenge/tons

|

Company name |

2018 Actual |

2019 Actual |

2020 Actual |

2021 Forecast |

2022 Forecast |

|---|---|---|---|---|---|

|

“Bogatyr Komir” LLP |

2,013 |

2,120 |

2,311 |

2,348 |

2,587 |

Coal mining tariffs of “Bogatyr Komir” LLP are approved independently by a price list for the RK consumers for 3 consumer groups (power sector at KTZh connecting station, power sector at the coal collecting station, public utility needs). Regulation is performed on the basis of the Entrepreneur Code of CRNM PC under MNE.

LIQUIDITY AND FINANCIAL SUSTAINABILITY INDICATORS

Fulfillment of external lenders’ covenants:

|

Covenant |

Standard |

2019 Actual |

2020 Actual |

Note |

|---|---|---|---|---|

|

Debt/EBITDA (EBRD, ADB) |

No more than 3,5 |

3.31 |

2.96 |

Is met |

|

EBITDA/interest (EBRD, ABD) |

No less than 3 |

3.34 |

3.76 |

Is met |

|

Debt/Equity (EDB and KDB) |

No more than 2 |

0.56 |

0.54 |

Is met |

|

Description |

2018 Actual |

2019 Actual |

2020 Actual |

2021 Forecast |

2022 Forecast |

|---|---|---|---|---|---|

|

Debt/EBITDA |

3.18 |

3.31 |

2.96 |

3.18 |

1.77 |

|

Debt/Equity |

0.65 |

0.56 |

0.54 |

0.58 |

0.50 |

|

Current liquidity |

1.04 |

0.70 |

0.75 |

0.75 |

1.30 |

At the end of 2020, “Samruk-Energy” JSC (hereinafter referred to as the Company) complied with financial and non-financial covenants of creditors, which are recorded on a semi-annual basis.

At the end of 2020, “Samruk-Energy” JSC reached the target indicators for financial stability ratios provided by the shareholder.

Debt reduction

At the end of 12 months of 2020, the consolidated debt of the Company amounted to 325.4 billion tenge, the decrease in debt for the reporting period compared to the results of 2019 (338 bn tenge) amounted to 12.6 billion tenge.

Debt reduction in 2020 is associated with scheduled debt repayments and early repayment of debts in the amount of 17.8 bn tenge.

As part of mitigating of currency risks, the Company carried out the following activities in 2019–2020:

Refinancing of foreign currency liabilities in tenge – “Moynak HPP” JCS in the amount of 148 mln US dollars, “Ekibastuz SDPP-2” JCS in the amount of about 100 billion tenge. As a result, the share of foreign currency liabilities in the loan portfolio was reduced to 1.5 %.

Due to the systematic work on debt management for the period from 2017 to 2020, Samruk-Energy reduced its debt by an estimated 94.5 billion tenge in balance terms, which is in line with the target indicators of financial soundness ratios set by the shareholder.

Interest expense optimization

At the same time, by the end of 2020, a decrease in expenses of about 1.3 billion tenge was achieved for remuneration due to planned and early repayment of debt, refinancing of foreign currency obligations and a decrease in interest rates on existing loans of the Group.

Credit Rating (Fitch Ratings)

At the end of 2020, the long-term ratings of “SamrukEnergy” JSC from the international rating agency Fitch Ratings were kept at the BB level, the forecast is Stable. At the same time, Fitch Ratings raised the senior unsecured rating of Samruk-Energy JSC from “BB-” to “BB”, and also raised its stand-alone credit rating from “b” to “b +”.

Deals

Information about material, major deals is disclosed in Financial statements of “Samruk-Energy” JSC (Volume 2).

Fines

The total amount of significant fines across “SamrukEnergy” JSC group of companies is 1,703.31 thous. tenge.

The authorized state agencies (labor inspection, workplace safety, fire safety, energy supervision and control, sanitary and epidemiological supervision) checked for compliance with legislative requirements and issued 25 prescriptions without imposing financial sanctions.

Cases associated with hindering competition and violation of antimonopoly legislation were not reported during the reporting year.

Significant fines in money terms and the total number of non-monetary sanctions imposed for non-compliance with environmental laws and regulations are listed in the Environment section.

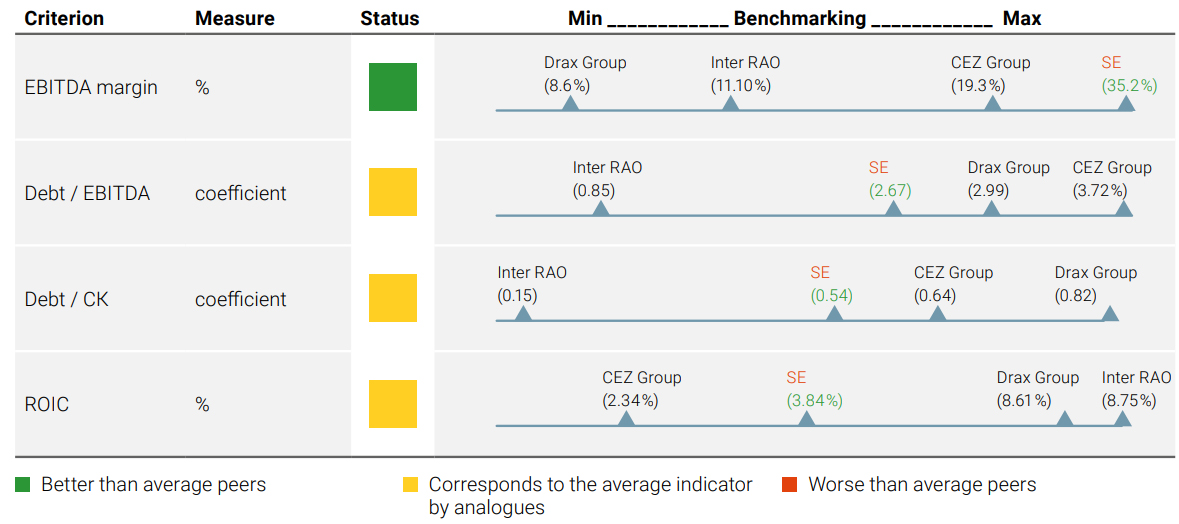

Benchmarking results:

Comparative analysis (benchmarking)

Benchmarking is one of the important elements of control of “Samruk-Energy” JSC. The purpose of the benchmarking is to compare the operating and financial performance with foreign companies – counterparts to identify the strengths and weaknesses of “Samruk-Energy” JSC. The companies selected for the comparative analysis are the leading electricity holdings in their respective countries. The scale of the companies in terms of capitalization is higher than “Samruk-Energy” JSC, since the compared companies operate in countries where electricity market is significantly higher in terms of capital employed and cash flows. For benchmarking the following indicators were used:

- EBITDA margin;

- Debt / EBITDA;

- Return on invested capital (ROIC);

- Ratio of the share of borrowed funds (Debt / Equity).

For benchmarking, data from the following analog companies were used:

- nter RAO UES PJSC (Russia);

- CEZ Group (Czech Republic);

- Drax Group (Great Britain).

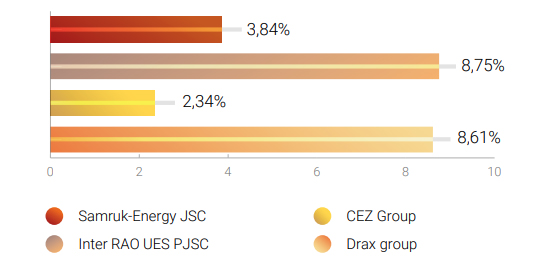

Return on Invested Capital (ROIC) for 2020

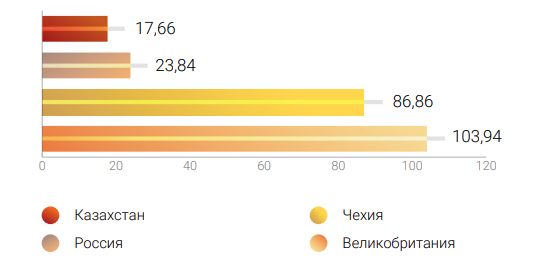

Average electricity rate in 2020, tenge/kWh

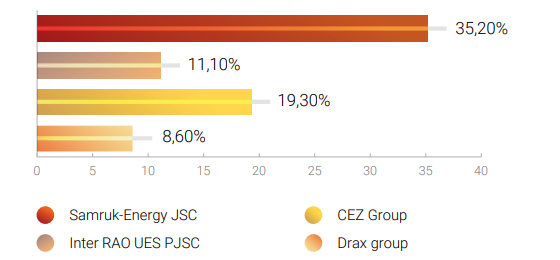

At present, in comparison with foreign peer companies, “Samruk-Energy” JSC is inferior in respect to certain indicators.

Financial stability indicators show that “Samruk-Energy” JSC fully uses available financial leverage.

At the same time, Samruk-Energy surpasses its peers in terms of EBITDA margin. This indicator indicates a high profitability of sales. In terms of ROIC (return on long-term invested capital) Samruk-Energy is at the level of European peers. At the same time, according to this indicator, Samruk-Energy is significantly inferior to the Russian holding, the specificity of whose activities is identical due to the similarity of the economic conditions of activity, which indicates the need to increase the efficiency (profitability, return) of investments.

It is worth noting that, in contrast to public companiesanalogues, Samruk-Energy JSC belongs to the Government of the Republic of Kazakhstan, and therefore, the Company is a conductor of state policy in the field of electric power. In this regard, as well as with a high degree of deterioration of the energy sector, socially significant investment projects have been implemented since 2009 (aimed at the reliability and uninterrupted operation of the energy system of the Republic of Kazakhstan), which led to a significant increase in invested capital and, accordingly, reduced the rate of return on investment.

An additional factor affecting the indicators of return on investment is the low level of electricity tariffs in the Republic of Kazakhstan in comparison with countries of similar companies

|

Country |

Aeverage tariff for 1 kWh |

In tenge/kWH |

Average exchange rate for 2020 |

|---|---|---|---|

|

Republic of Kazakhstan |

17.66 tenge |

17.66 tenge/kWh |

|

|

Russia Federation |

4.15 ruble |

23.84 tenge/kWh |

5.74 tenge/ruble |

|

Czech Republic |

0.18 euro |

86.86 tenge/kWh |

471.81 tenge/euro |

|

Great Britain |

0.22 euro |

103.94 tenge/kWh |

|

Source: ru.investing.com:

Source: ru.investing.com: