INVESTMENT ACTIVITY MANAGEMENT

The company applies a portfolio approach to selection, assessment and management of projects and assets, which enable it to efficiently allocate financial, technical, technological, human, and other resources in investments with an acceptable risk level.

Portfolio management of investment projects includes a set of activities, such as planning individual programs and projects, determining the amount of equity available for investment, prioritizing projects depending on amount of available resources, risk balancing, return and time horizon, as well as project indicators revision.

The Company’s key tool for management of investment projects portfolio are:

1) Development Strategy and Development Plan of “SamrukEnergy” JSC group of companies, as well as targeting of task-oriented KPI across “Samruk-Energy” JSC group of companies.

As an operating energy company, the Company manages its portfolio of investment projects based on KPI developed within implementation of the Company’s Development Strategy. The KPI system provides a link between the Company’s strategic goals, its SA, operating and investment activities and the management system.

2) Assessment of the impact of the external environment and megatrends on the value of investment projects portfolio.

The company evaluates the impact of external factors on the state of investment project portfolio by simulating changes in macroeconomic indicators, such as the price of commodities, foreign exchange rate, inflation rate, etc. Scenario analysis allows obtaining the information on how the cost of investment projects portfolio changes depending on external circumstances.

2) Modeling investment decisions and assessing their impact.

The Company fairly assesses the total cost of investment projects portfolio and assets of the Company and individual values of each investment in the investment project, as well as evaluates the impact of individual projects on the “SamrukEnergy” JSC portfolio.

In-depth and regular monitoring of key investment indicators is essential for development of recommendations by Recommendation body and making timely decisions by the Company’s management. The Company conducts proper monitoring of investment projects for prompt adoption of corrective measures.

To fulfill its obligations and increase the value of its assets in the long term, the Company promotes responsible investment. As part of the Development Strategy and the Corporate Governance Code, the Company took the initiative to introduce and integrate sustainability principles in the Company’s operations.

In assessing the ESG, the Company is guided by the provisions of the Corporate Governance Code and the best-in-class international standards recognized by the international community, such as the UN Sustainable Development Goals, the Global Reporting Initiative, IFC and EBRD Environmental and Social Standards, the UN Principles for Responsible Investment, etc.

The company adheres to the following key principles directly related to investments:

- incorporating ESG criteria in the investment analysis and decision making process;

- compliance with the Republic of Kazakhstan legislation and proper use of confidential information;

- preparation of annual reports, including financial statements, reports on sustainable development, including ESG factors, in accordance with generally recognized international or national auditing standards;

- availability of formal risk identification, assessment and management system

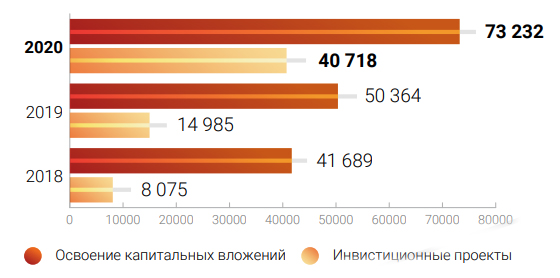

Investment costs, million tenge

The investment program is financed using own funds, debt financing of international financial organizations and secondtier banks of the Republic of Kazakhstan.

The investment program is financed, mln tenge

|

|

2018 actual |

2019 actual |

2020 actual |

|---|---|---|---|

|

TOTAL |

41,689 |

50,364 |

73,232 |

|

own |

35,342 |

42,836 |

35,129 |

|

borrowed |

6,211 |

7,528 |

35,122 |

|

State budget funds |

137 |

– |

2,982 |